As we sift through the property landscape in the UK, an alarming trend surfaces, casting a long shadow over the dreams of the nation’s youth. The last three decades have witnessed a substantial dip in young homeowners within the country, signalling a shift that begs analysis and action.

A Walk Through Time: The 1990s to Now

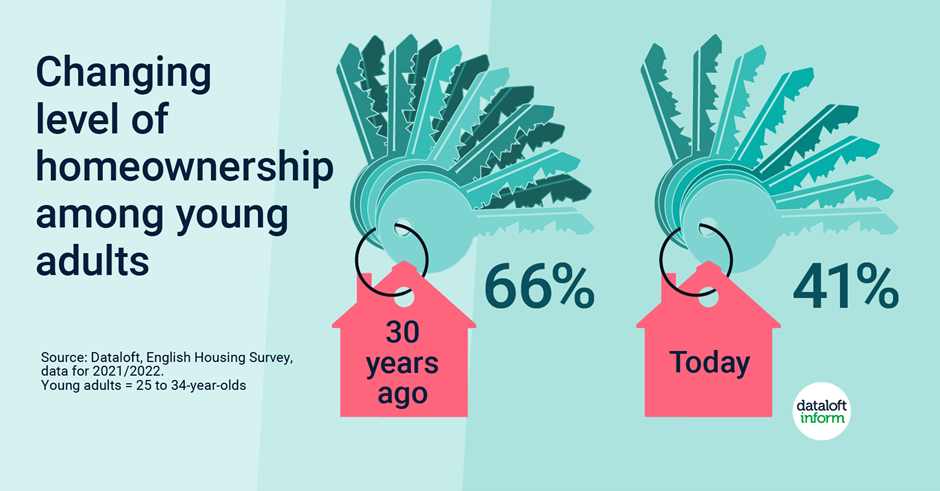

Not so long ago, the 1990s portrayed a promising picture for young adults venturing into homeownership. Fast forward to today, and the scenario is starkly different. Based on insights provided by Dataloft Inform, it is evident that individuals aged 25 to 34 are less likely to own a property now than they were thirty years ago. What has led to such a tectonic shift in a society where owning a home represents a cornerstone of stability and success?

Understanding the Financial Gulf

Inflation and living costs have surged, yet, disappointingly, the average income, especially for the younger generation, has struggled to keep pace. The resultant effect is a financial gulf, making it strenuously difficult for young aspirants to save for deposits, let alone afford the mortgage payments.

Furthermore, the increase in property prices has exponentially outstripped the rise in wages. Dataloft Inform reports that the gap between property prices and income has widened, meaning homes are less affordable now. This discrepancy is not just a number but a barrier, thwarting dreams and practical possibilities alike.

The Burden of Higher Education Costs

Gone are the days when students would walk out of universities debt-free. The current generation is often laden with substantial student loans, making saving a portion of their income a more daunting task. This financial burden significantly delays their plans to hop onto the property ladder, pushing homeownership into the realm of distant future rather than an accessible reality.

The Private Rental Trap

With the dream of homeownership drifting further out of reach, young adults turn to the next available option: the rental market. However, high and ever-climbing rents, coupled with stiff competition for rental properties, eat into the potential savings that could otherwise have been set aside for a property deposit. This vicious cycle, known as the “private rental trap,” continues to undermine the ability of young individuals to transition from renters to homeowners.

Complications of the Mortgage Market

While property prices are a substantial part of the issue, the complexities and stringencies of the mortgage market play a non-negligible role. The days of easier credit that might have benefited previous generations are long gone. Post the financial crisis, lenders are more cautious, imposing stricter criteria and requiring higher deposits. These conditions pose yet another poignant struggle for young adults to overcome in their homeownership quest.

Societal Shifts and Lifestyle Choices

It’s not all about economics; societal changes contribute too. Modern young adults often prioritise flexibility due to career choices, travel or simply a not-yet-decided future. The commitment of a mortgage ties one down, both financially and geographically, which doesn’t always align with contemporary lifestyle choices.

Moreover, the shift towards single-person households has led to a decrease in shared financial responsibilities, making it tougher for individuals to manage the costs associated with homeownership.

Embracing the Shared Ownership Scheme

In the wake of these challenges, shared ownership schemes have emerged as a beacon of hope. These allow a person to buy a share of a home (between 25% and 75% of the home’s value) and pay rent on the remaining share. It’s a stepping stone, making homeownership accessible, albeit at a smaller scale.

The Call to Collective Action

This significant decline in young homeowners is not just their dilemma; it’s a societal concern. Addressing it calls for collective action from the government, lenders, and real estate stakeholders. Measures like more affordable housing, relaxed lending criteria, and effective financial education could be pivotal.

However, the journey from aspiring homeowner to actual homeowner is complex. If you are a young individual facing these issues, consider seeking advice from property experts. Professional guidance can navigate the convoluted realms of deposits, mortgages, and government schemes designed to help you.