The rental market is witnessing an upward trend across England and Wales, with landlords receiving increased yields on their investment properties. This boost comes at a time when the demand for rental accommodations continues to grow, underscoring the resilience and attractiveness of the buy-to-let sector. In this article, we delve into the latest data from Dataloft, highlighting the performance of rental yields in various regions and exploring the factors contributing to this positive trajectory.

A Flourishing Landscape

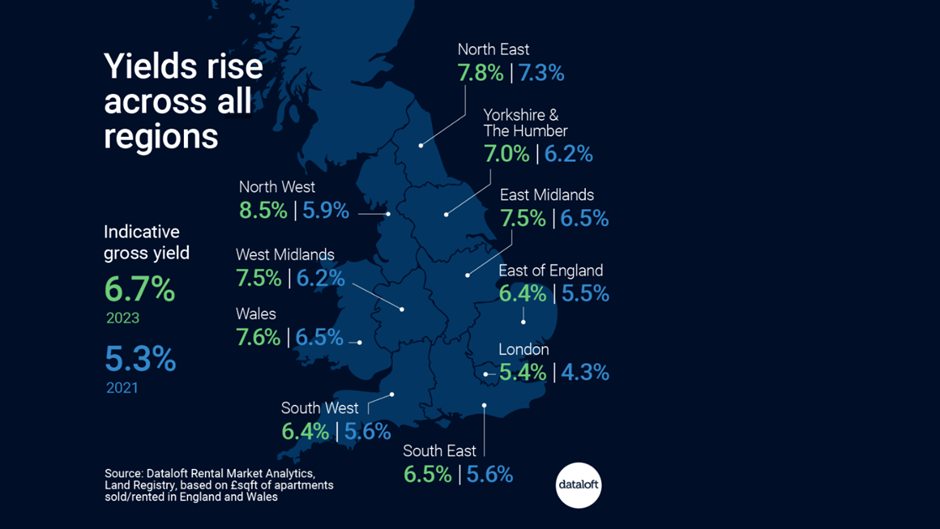

Indicative gross yields have shown a significant improvement, marking a positive shift for landlords and investors. In 2023, the analysis of apartments sold and rented out reveals an average gross yield of 6.7%, an increase from 5.3% in 2021. This uplift is a testament to the buoyant rental market and its potential for robust returns.

Regional Highlights

Yields have seen an upswing in every region, with the North West leading the charge at an impressive 8.5%. This remarkable growth is not isolated, as other areas have also reported noteworthy increases:

- The North East experienced a yield rise to 7.8% in 2023, up from 7.3% in 2021.

- Yorkshire & Humber’s yields climbed to 7.0% from 6.2%.

- The East Midlands saw an increase to 7.5%, up from 6.5%.

- Yields in the West Midlands matched the East Midlands at 7.5%, rising from 6.2%.

- Wales reported a yield of 7.6%, improving from 6.5%.

- London, often seen as a challenging market for yields, rose to 5.4% from 4.3%.

- The South East and South West both enjoyed increases, with yields rising to 6.5% and 6.4% respectively from 5.6%.

Landlord Perspectives

Amidst this positive landscape, the outlook among landlords remains optimistic, with 66% planning to maintain their current portfolio size and 13% looking to expand. The primary motivations for growth include building an investment business, securing a pension and the belief in property as the safest investment avenue. This confidence is further bolstered by the forecast that rental growth will outpace sales market growth in 2024, with an anticipated rise of 5%.

Looking Forward

The rental market’s resilience and potential for growth are clear, offering compelling opportunities for current and prospective landlords. With yields on the rise across all regions and a forecast of continued rental growth, the sector represents a valuable investment avenue.

Whether you’re considering entering the buy-to-let market or looking to expand your existing portfolio, Northwood is here to guide you through every step of the process. Our expertise and comprehensive services ensure your investment journey is successful and hassle-free. Contact us today to explore how you can capitalise on the thriving rental market and secure your financial future.

Sources

- Dataloft Rental Market Analytics

- Land Registry, based on £/sqft of apartments sold/rented in England and Wales

- Property Academy Landlord Survey 2023

- Zoopla

This article leverages insights from Dataloft and other reputable sources to provide a comprehensive overview of the rental market’s performance. By staying informed and strategic, landlords can navigate the market with confidence, ensuring their investments yield the best possible returns.