Entering the property market as a first-time buyer is an exciting yet challenging journey, often marked by saving for that crucial deposit. This article delves into the latest insights from Dataloft and the English Housing Survey 2021/22, shedding light on how first-time buyers in the UK are navigating the financial hurdles of purchasing their first home.

Average Deposit and Income Statistics

The journey begins with understanding the average deposit. According to Dataloft, the average deposit paid by a first-time buyer was £43,693. This figure is significant, especially considering that almost two-thirds (63%) of these buyers fall within the top 40% income bracket. This statistic highlights a clear correlation between income levels and the ability to accumulate a substantial deposit.

Deposit Percentages and Mortgage Freedom

The composition of deposits is another area of interest. Just over two-thirds (68%) of first-time buyers managed to secure their property with less than a 20% deposit, suggesting a reliance on high loan-to-value mortgages. Remarkably, a small but fortunate 5% of buyers were able to bypass a mortgage entirely. This portion of the market represents an interesting anomaly, likely driven by significant financial gifts or inheritances.

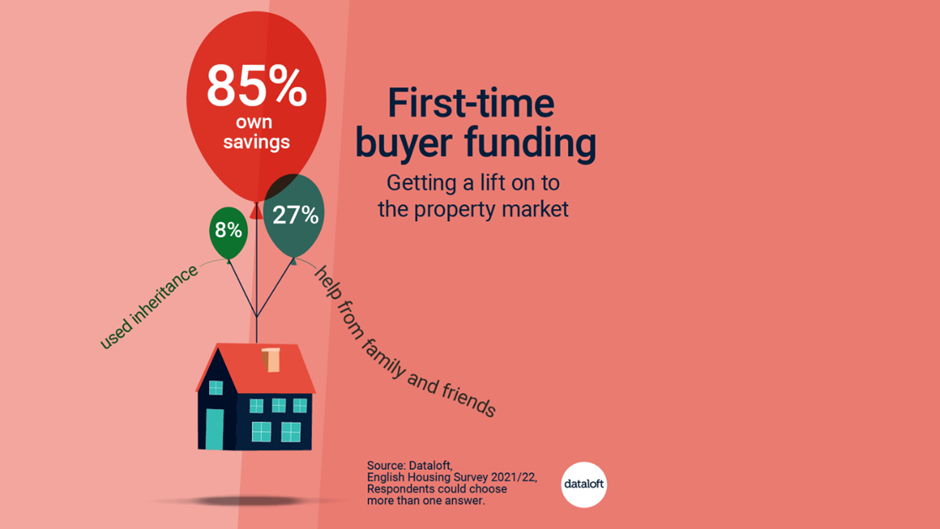

Sources of Funding

When it comes to raising the funds, 85% of first-time buyers reported using their savings, a testament to the discipline and commitment required to enter the housing market. In addition to personal savings, 27% received financial assistance from family and friends, and 8% benefited from inheritance. These figures illustrate the diverse and often complex mix of funding sources that first-time buyers rely on.

Market Dynamics and First-Time Buyers

Despite the daunting costs associated with buying a first home, first-time buyers are a resilient bunch. They accounted for 53% of all home moves in the third quarter of the surveyed year, the highest proportion in over a year. This resilience, combined with a market showing signs of increasing stability and potentially lower mortgage rates, suggests that the coming months may see even more first-time buyers stepping onto the property ladder.

Looking Ahead

The future looks promising for those aspiring to own their first home. With the possibility of more favourable mortgage rates and a stabilising market, the dream of homeownership is becoming more attainable. First-time buyers should continue to explore all available avenues for funding, including savings, family support, and other financial instruments, to position themselves strongly in this competitive market.

Government Schemes and Support for First-Time Buyers

The UK government offers several supportive initiatives for first-time buyers. A notable example is the Shared Ownership scheme, which allows purchasers to buy a share of a home (between 25% and 75% of the home’s value) and pay rent on the remaining share. This can be particularly advantageous for those struggling to afford a property outright. Additionally, the First Homes scheme is a recent initiative aimed at helping local first-time buyers and key workers. It offers homes at a discount of at least 30% compared to the market price. These programmes, among others, are designed to ease the financial strain of entering the housing market and make homeownership more accessible for first-time buyers. Prospective homeowners should explore these options, as they can provide significant assistance in bridging the gap between savings and the cost of a first home.

Are you a first-time buyer looking to navigate the complexities of purchasing your first home? Our team of experienced Northwood estate agents is here to guide you every step of the way, from understanding your options to finding the perfect property. Contact us today to begin your journey towards homeownership.

Footnote This article is based on data from Dataloft Inform and the English Housing Survey 2021/22. For more information, visit Dataloft and the English Housing Survey 2021/22.