Rental prices have seen significant growth over the past few years, impacting affordability for many renters across the UK. This article delves into the current rental price growth, how it has moderated recently and its implications for renters. Using data from Dataloft, we explore the trends and forecasts in the rental market.

Recent Trends in Rental Price Growth

Over recent years, rental prices in the UK have experienced substantial increases. In June 2023, annual rental growth peaked at 10.4%, reflecting a sharp rise in the cost of renting a home. However, as of now, this growth has moderated slightly to 7.9%. This deceleration is a welcome sign for many renters who have been grappling with escalating costs.

The high rental growth in previous years can be attributed to various factors, including increased demand for rental properties, limited housing supply and rising property prices. These factors have collectively exerted upward pressure on rents, making it more challenging for renters to find affordable housing.

Affordability Concerns

Affordability has become a critical issue in the rental market. In April, renters were spending an average of 33.3% of their income on rent. This high percentage underscores the financial strain faced by many households. The situation has worsened over the past year, with affordability weakening across all UK regions.

The North East and Wales have seen the most significant declines in renter affordability. In these regions, the proportion of income spent on rent has risen considerably, exacerbating the financial burden on renters. This trend highlights the need for more affordable rental options and policies that address the root causes of rising rental prices.

Regional Variations

While affordability has generally weakened across the UK, there are notable regional differences. The North East and Wales have experienced the most pronounced declines in affordability, but other regions are also feeling the pinch. For instance, London, traditionally one of the most expensive places to rent, continues to see high rental prices, although the rate of increase has slowed slightly.

In contrast, some regions have seen more moderate rental growth. For example, areas in the Midlands and the South West have experienced lower increases in rental prices compared to other parts of the country. These variations reflect the diverse economic and housing market conditions across the UK.

Future Outlook

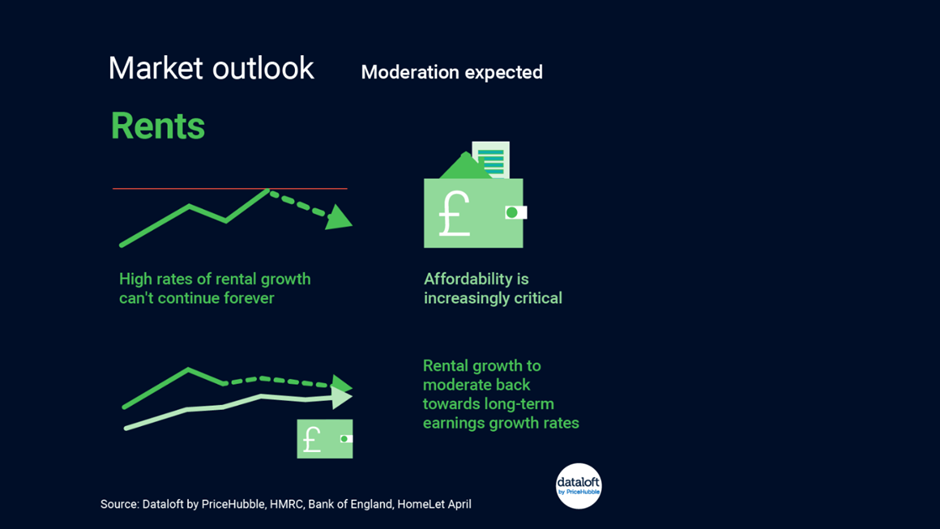

Looking ahead, rental growth is expected to remain relatively high in 2024, albeit lower than the rates seen in recent years. According to Dataloft, rental growth rates are anticipated to moderate further, aligning more closely with long-term earnings growth. By 2025 and beyond, annual rental growth rates are projected to be around 3%, which is more sustainable and reflective of historical trends.

This moderation in rental growth is likely to be driven by several factors. Economic conditions, changes in housing supply and government policies aimed at improving housing affordability will all play a role in shaping the rental market. Additionally, as the cost-of-living crisis continues to affect many households, there may be increased pressure on landlords to keep rent increases in check.

Implications for Renters and Landlords

For renters, the expected moderation in rental growth is a positive development. It offers some relief from the rapid increases of recent years and provides a more stable environment for budgeting and financial planning. However, given that affordability remains a concern, renters should continue to explore all available options, such as negotiating rents, seeking out more affordable areas, or considering shared housing arrangements.

For landlords, the changing rental market presents both challenges and opportunities. While the potential for high rental income may decrease slightly, maintaining good tenant relationships and ensuring properties are well-maintained will be crucial for long-term success. Landlords should also stay informed about policy changes and market trends to adapt their strategies accordingly.

Rental price growth in the UK has moderated from its peak but remains a significant concern for affordability. Renters are spending a substantial portion of their income on rent, with regional variations highlighting the diverse impacts across the country. As we move further into 2024 and beyond, rental growth is expected to align more closely with long-term earnings, offering some relief to renters.

At Northwood, we are committed to helping renters and landlords navigate these changes. Whether you are looking for a rental property or need advice on managing your rental portfolio, our team of experts is here to assist you. Contact us today to learn more about our services and how we can support you in the evolving rental market.