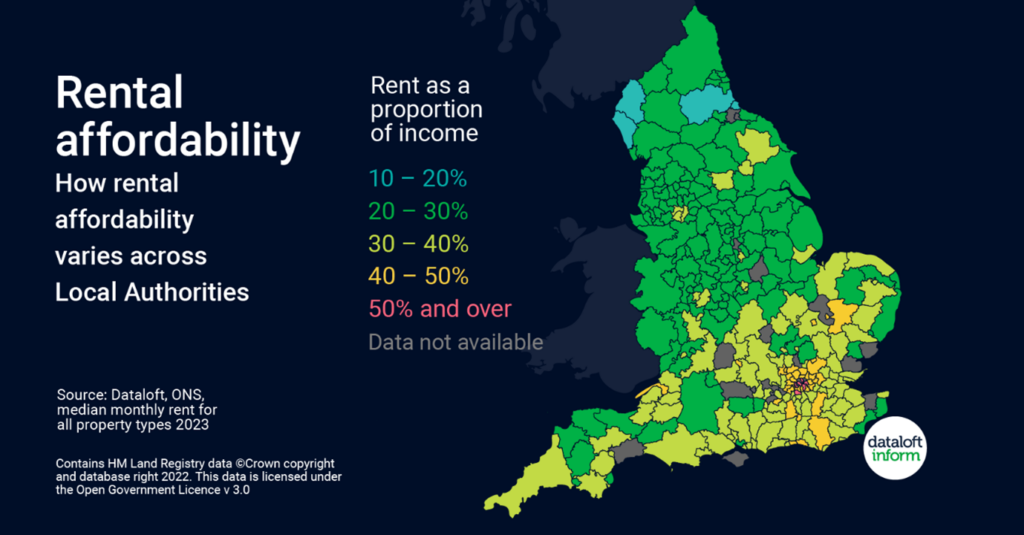

Rental affordability is a critical topic for landlords and tenants alike in England. It reflects the proportion of earnings dedicated to covering rent in various local authorities. This article, drawing upon Dataloft Inform data, explores how rental affordability varies across England, revealing significant regional disparities.

Earnings vs Rent: The Southern England Perspective

In the south of England, generally known for its higher earnings compared to other regions, tenants face a unique challenge. Despite higher incomes, a larger portion of these earnings is consumed by rent. This phenomenon indicates a disparity between income and housing costs, making it crucial for landlords to understand the financial pressures faced by tenants in this region.

The London Scenario: High Earnings, Higher Rents

London’s rental market is particularly pressured. For an average Londoner earning a typical salary, over 40% of their income goes towards rent. This percentage is substantially higher than in many other parts of the country, where rent typically consumes between 20% and 30% of a tenant’s earnings. This disparity highlights the acute affordability issues in the capital.

Balancing Act: Earnings Growth vs Rent Increases

Nationally, there’s a silver lining. Although rents have been rising, so have salaries. This increment in earnings helps mitigate some of the financial strain caused by increasing rents. However, the balance between earnings growth and rental price hikes is a delicate one, and landlords should remain aware of these dynamics to maintain fair and sustainable rental practices.

Surprising Affordability in Home Counties

Contrary to expectations, certain areas in the home counties, such as East and North Hertfordshire, Dover, and Folkestone, exhibit more affordable rental markets. In these areas, only about 20–30% of a tenant’s income is spent on rent, aligning more closely with national averages outside of London. This data suggests that despite being in proximity to high-rent zones, there are pockets of relative affordability.

Implications for Landlords

It’s clear that the rental affordability issue is nuanced and varies significantly by region. In particular, the stark contrast between London and other parts of the country, including some areas of the Home Counties, highlights the diverse challenges and opportunities facing landlords in different regions.

For landlords, this analysis is not just about understanding where the rental market stands today, but also about anticipating future trends and preparing for them. The rental market is dynamic, and being aware of these regional disparities is crucial for making informed decisions about property investments, rent setting, and tenant relations.

Landlords might want to consider the broader economic context in which these affordability issues exist. Factors such as job market stability, cost of living, and local economic growth can greatly influence rental markets. By staying attuned to these factors, landlords can better understand their tenants’ circumstances and adapt their rental strategies accordingly.

This awareness also positions landlords to contribute positively to the housing market. By offering fair rents and understanding tenants’ financial constraints, landlords can help ensure that the rental market remains accessible and sustainable for a diverse range of tenants. This approach not only benefits tenants but can also enhance the reputation and long-term success of landlords in a competitive market.

Rental affordability in England presents a complex picture with significant regional variations. As landlords, staying informed and empathetic towards tenants’ circumstances is key. This understanding can guide more equitable and profitable rental practices, ultimately benefiting both landlords and tenants in the ever-evolving landscape of the English rental market.

Landlords are encouraged to engage with local landlord associations, and stay updated with market analytics to remain competitive and responsible in their role. Remember, a balanced rental market benefits everyone involved.

This article is based on data from Dataloft Rental Market Analytics. For more detailed information and insights, please visit: https://www.dataloft.co.uk/dataloft_inform