In the ever dynamic UK rental market, a significant trend has emerged: rising rental prices driven by robust demand. This article delves into the findings from Dataloft Inform, highlighting the escalating competition among tenants and its impact on rental prices across the UK.

Surging Above Asking Prices

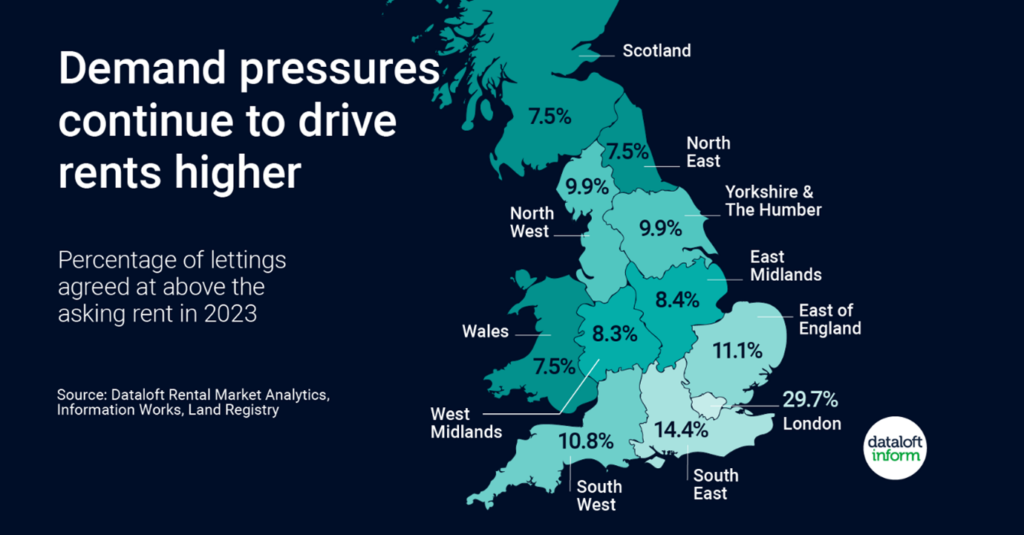

Recent analysis from Dataloft Inform reveals a remarkable shift in the rental market. Almost one in six rental transactions in 2023 were finalised above the asking rent, a stark contrast to the less than one in 15 in 2019. This trend underscores the growing competition among prospective tenants, particularly in high-demand areas.

London: A Prime Example

The situation is most pronounced in London, where a staggering 30% of rentals agreed this year exceeded the asking price. This phenomenon is not limited to the capital; similar pressures are evident across the UK, signalling a widespread shift in the rental landscape.

Regional Variations

The wider South East region also experienced this trend, with 14% of new rentals being settled above asking rents. Additionally, more than 10% of rentals in four other UK regions – the East of England, North West, South West, and Yorkshire & Humber – have seen similar patterns, illustrating the pervasive nature of this demand-driven market.

Pandemic Aftermath and Rent Increases

The imbalance between supply and demand for rental properties, which has been escalating since the pandemic, is a key driver of this trend. Across most of the UK, average monthly rents have surged by 41% since 2019. This increase significantly outpaces the house price growth during the same period, which stands at 25%.

Understanding the Drivers

Several factors contribute to this burgeoning demand. The lingering effects of the pandemic, such as changes in work patterns and a desire for more space, have altered tenant preferences. Additionally, the economic landscape, coupled with the challenges in the housing market, has led more individuals to opt for rental accommodations.

Implications for Landlords

For landlords, this presents both opportunities and challenges. The potential for higher rental income is evident, yet it also necessitates staying attuned to market dynamics to optimise rental strategies. Understanding regional variations and tenant preferences becomes crucial in navigating this evolving market.

Navigating the Market

Landlords must be proactive in managing their properties and responsive to the shifting demands of tenants. Regular market analysis, tenant engagement, and strategic pricing are key to maximising returns while maintaining high occupancy rates.

The current landscape of the UK rental market is characterised by strong demand driving up rental prices. As a landlord, staying informed and adaptable is vital in leveraging this trend for sustainable growth. We encourage landlords to regularly review their rental strategies, consider tenant preferences, and stay updated with market analyses to make informed decisions.

This article is based on data and analysis from Dataloft Rental Market Analytics and Information Works, as well as the Land Registry. For more detailed insights and regional data, visit the Dataloft Inform website at https://dataloftinform.co.uk/ Additional statistics and trends can be accessed at the Land Registry’s official site: https://www.gov.uk/government/organisations/land-registry