The UK rental market has seen a significant shift in recent years, with Homes in Multiple Occupation (HMOs) becoming increasingly popular among renters and investors alike. In this article, we delve into the reasons behind this rise in popularity, exploring yield potentials and using insightful data provided by Dataloft Inform.

The Cultural Influence of HMOs

We can’t talk about HMOs without mentioning the cultural impact of TV shows like Friends. These iconic series painted an alluring picture of shared living, portraying it as a fun, cost-effective way of experiencing city life. Indeed, for many people today, HMOs offer the perfect solution to rising rental costs. With over half a million HMOs in England and Wales, it’s clear that shared accommodation plays a crucial role in keeping rent affordable for many.

HMOs: A Win for Investors

Not only do HMOs benefit renters, but they also present lucrative opportunities for investors. For instance, properties in the North West have shown potential gross yields averaging 7.9%. This growth is evident in Manchester, where the student rental stock has risen by an impressive 26.5% in just half a decade. Data from The HMO Hub further emphasises the potential of HMOs, revealing that their gross yields consistently outperform standard buy-to-let properties.

Geographic Distribution and Yields

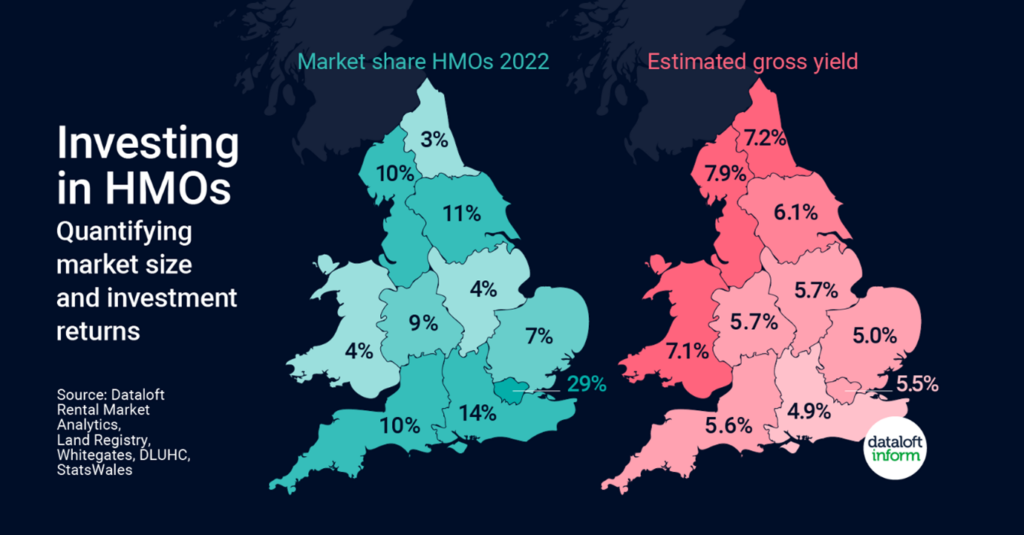

Though London boasts the highest number of HMOs, it is the North West, North East, and Wales that promise the most attractive yields. With London accounting for 29% of HMOs in England and Wales, the principle of scarcity comes into play in regions with fewer HMOs. For example, Wales, which constitutes only 4% of the HMO market, offers compelling average yields of 7.1%.

Benefits of Letting as an HMO

For landlords considering their options, letting a property as an HMO provides several distinct advantages over traditional buy-to-let. One of the key benefits is profitability. By renting out individual rooms, landlords can command a higher overall rental income than if they were to let the entire property to a single tenant. Moreover, with multiple tenants, the financial impact of void periods – times when a room remains unoccupied – is lessened, ensuring a steadier income flow.

In regions like the North West, where there is a substantial student population, the demand for affordable housing solutions is robust. As a result, landlords can expect estimated gross yields of up to 7.9%.

The Case for HMOs

With their increasing demand, coupled with the potential for high yields, HMOs present a compelling case for landlords and investors. Whether you’re new to property investment or an experienced landlord considering diversifying your portfolio, the data suggests that HMOs are worth serious consideration.

If you’re considering tapping into the HMO market or need advice on managing an existing HMO property, get in touch with us today. Let’s explore the opportunities together and maximise your return on investment.